- Home

- About Us

- Sustainability

- Investors

- News

- People & Culture

-

Regions

Consider an ambitious woman who lives in a remote part of Zambia. She runs a small business, and starts using mobile money to accept payments from customers. With that same mobile money platform, she starts to send funds to family members in other parts of the country, paying for emergencies, health care and everything else her family may need. She may be hundreds of kilometres away, but her family still needs her, and she is able to meet their needs because of the technology in her pocket. Using mobile money to pay for her daughter’s school fees saves the woman from queuing to pay bills, buying her more time to increase her business revenue. When the sun sets, she uses mobile money to access solar power solutions so she can turn the lights on and keep going. And when she is ready to take her business to new heights, it is through mobile money that she can access a micro loan because mobile money has given her a financial history. This financial stability leads to stability in her business and in her home.

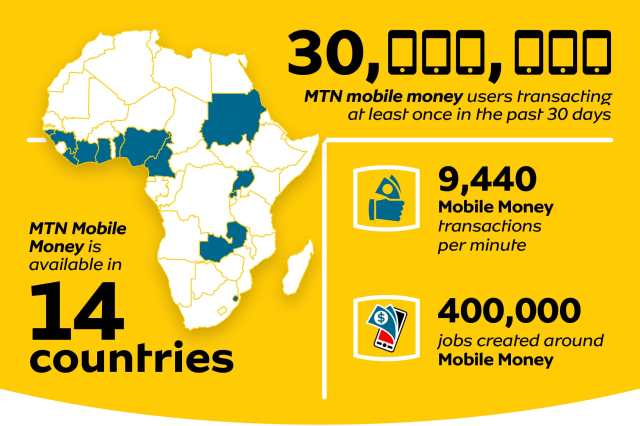

MTN now has 30 million active mobile money subscribers in 14 countries on the continent.

The range of solutions to close the financial services gap in the markets in which we operate requires partnerships with financial services providers, regulatory authorities, other mobile network operators, merchants, distributors, innovators and business associations. It is through working with our partners that MTN now has 30 million active mobile money subscribers in 14 countries on the continent – this has significantly improved the economic and social well-being of millions of Africans.

How Mobile Money Affects Social and Financial Inclusion

How Mobile Money Affects Social and Financial InclusionThe World Bank defines social inclusion as the process of improving the terms for individuals and groups to take part in society. Participation in society comes in three forms; markets, services and spaces. Markets, specifically, refer to labour, housing and credit. Mobile money is giving unbanked people in Africa the opportunity to participate in local and global markets. When wages are paid digitally to a mobile wallet, people with no traditional ‘paper trail’ suddenly have a digital trail and proof that they are able to earn and spend, and most importantly, save. Creating or growing a business becomes a reality, because money can safely be put aside for future investments. Eventually, that growing business requires staff to operate and continue growing. So jobs are created, and the community benefits.

This is not the story of one woman who wanted to grow a business. It is the story of millions of people in Africa on a journey to financial transformation. We estimate that MTN Mobile Money has contributed to the creation of 400 000 jobs across the company’s footprint. If you’d like to read about the ripple effect of this phenomenon, click here.

References:

OECD Library – Africa’s Development Dynamics 2018

The World Bank – Social Inclusion in Africa