- Home

- About Us

- Sustainability

- Investors

- News

- People & Culture

-

Regions

Cause and effect. It is the backbone of science, and the reality of our daily lives. Sometimes, the effect is minimal and even unremarkable. Other times, the effect is big enough to change the trajectory of entire lives.

We see examples of cause and effect in technology all the time. A single tweet, a new invention, a simple app, can change the future. One example worth noting, is mobile money. Mobile money is changing the way millions of people manage their finances, and it has led to the creation of a new ecosystem. We estimate that the MTN mobile money ecosystem has contributed to the creation of 400 000 jobs across our footprint.

Consider how different your life would be if you didn’t have access to financial services. Is there a safe place for you to put your salary, in cash, every month? How would you purchase a home or pay school fees? Would you be able to stand in a queue every month to pay your bills in cash? Would you ever have a chance to get a loan? For the majority of people living in Africa, this is reality. The rise of mobile money is not just convenient, it is life changing. And it has created a ripple effect across an entire continent which goes much further than convenience.

The GSMA reports that more than a decade into the creation of mobile money, transactions to the value of $1.3 Billion per day were done in 2018.

A typical active mobile money user transacts to the value of $206 per month. This number is expected to grow as the adoption of mobile money is growing by 20% every year. MTN is proud to play a part in financial transformation on the continent, ensuring that our subscribers have access to a mobile way of managing money where traditional institutions are unable to assist.

Imagine yourself as a talented entrepreneur living in an African country, selling products to people in your community. A laptop and a mobile phone may enable you to build an online store and market your products to the world, but without a bank account, how would you make transactions beyond your physical reach? Mobile money is giving entrepreneurs a chance to start and grow their businesses. With more successful businesses, come more opportunities for employment.

Mobile Money provides two streams of financial empowerment. The first, is that with a small sum of cash and a mobile phone, the youth which make up the majority of Africa, can become Mobile Money agents. Today MTN Mobile Money is working with 400,000 agents . The second stream is for innovative entrepreneurs who leverage mobile money to collect payments. The ability to collect payments digitally is a step toward digitizing a business and being truly innovative. For example, prepaid solar power and water providers have been able to reach remote areas of the continent while insurance companies have been able to disrupt their commercial models by creating products for consumers that previously had no access to insurance services – all by leveraging the mobile money platform.

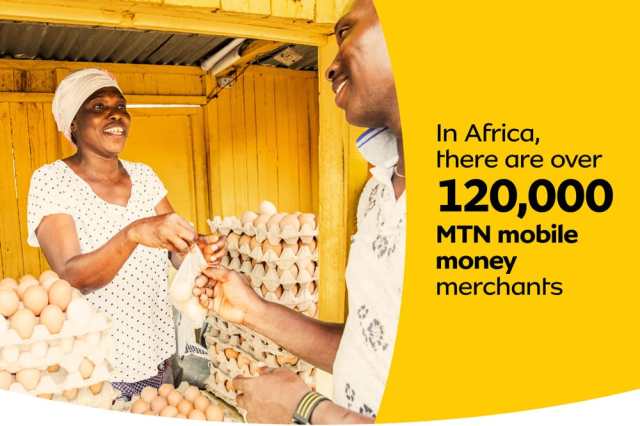

With the rise of mobile money, came the demand for merchants. There are 120 000 MTN mobile money merchants in Africa which implies 120 000 businesses have been able to increase their revenue. By accepting digital payments and bringing a digital element to traditionally brick-and-mortar businesses, Mobile Money can play a central role in empowering entrepreneurs. Becoming true drivers for economic and social growth, entrepreneurs can grow their businesses and employ people. This has a direct effect on the bottom line for people who have previously been ignored by traditional financial institutions.

A simple app, a few organisations working together, a continent full of talents and entrepreneurs and millions of people in need of financial services have contributed to the creation of 400 000 jobs. Could you think of a better example of technology making a meaningful impact?