- Home

- About Us

- Sustainability

- Investors

- News

- People & Culture

-

Regions

Small and medium-sized enterprises (SMEs) form the backbone of economies worldwide, particularly in developing and emerging markets. These enterprises contribute significantly to employment, income generation, and economic growth. In Africa, SMEs employ an estimated 80% of the continent’s workforce, both in formal and informal sectors, making them pivotal to economic prosperity and societal well-being.

However, small businesses and startups encounter various challenges that impede their growth and sustainability. These challenges include limited access to finance, markets, skills, technology, and infrastructure. Moreover, traditional banking services often fail to provide SMEs with the tailored solutions they need, leading to inefficiencies and frustrations.

Recognising the vital role SMEs play in Africa’s economic landscape, MTN is committed to empowering these enterprises through innovative financial solutions. At the forefront of this endeavor is MTN’s MoMo platform, a mobile financial service that caters to people across Africa and businesses of all sizes.

Since its inception, MoMo has evolved into a comprehensive ecosystem offering a myriad of services, including payments, e-commerce, personal insurance, lending, and more. One of the groundbreaking developments within this ecosystem is the MoMo Business Wallet, designed to streamline operations and optimise efficiency for businesses. The platform enables businesses to accept payments directly from customers for various transactions, from prepaid services to shopping vouchers, without incurring transaction fees. This not only enhances profitability but also grants businesses access to a vast customer base that has embraced MoMo wallets.

Moreover, MTN has democratised access to its mobile money platform through open application programming interface (API) solutions. Our open API software platform allows developers and programmers to integrate MoMo into their applications seamlessly, unlocking new possibilities for SMEs. MoMo APIs are available to facilitate all key use cases, including consumer to business payments (C2B), business to business payments (B2B), collections, and disbursements, cash in, cash out, refunds, notifications, and more. SMEs can even easily integrate a collection widget on their websites using the MoMo API, enabling customers to make payments by scanning a QR code.

MTN’s MoMo APIs represent a game-changer for SMEs seeking secure payment solutions and efficient transactions. Through these APIs, businesses can leverage innovative solutions for a range of financial and operational needs, propelling them towards growth and success.

Medhi Matovu, an entrepreneur from Uganda, has used MoMo APIs to boost his business, Lusuku, to new heights. Medhi explained that “Before integrating the MoMo API, we encountered challenges with cash transactions, including cases where drivers disappeared with funds. The API transformed our payment process, making it seamless and secure. Now, our drivers only focus on delivering products, while the API takes care of the monetary transactions.”

“The transition was remarkably smooth, thanks to the comprehensive documentation available on the MoMo website and an active developer community. With the API, we’ve experienced improved accuracy and speed in processing payments. The MoMo API not only boosted conversion rates but also increased customer confidence. The ease of making payments without extensive verifications has positively impacted user behavior. The return rate has surged compared to cash transactions, as customers have a clear record of their interactions.”

Moreover, Medhi emphasises the scalability and flexibility of the MoMo API, noting its ability to handle any volume of orders and adapt to dynamic user requirements. He credits MoMo APIs with increasing revenue and minimising losses, heralding it as a game-changer for developers seeking reliable and scalable solutions in the e-commerce landscape.

Success stories, such as those of Medhi Matovu, inspire MTN to amplify our efforts to empower SMEs by providing them with the necessary tools, resources and support to thrive in a competitive business landscape. As MTN continues to expand its partner ecosystem and fintech capabilities, we remain committed to supporting SMEs on their journey towards growth and success. Through MoMo and our comprehensive range of SME services and solutions, we aim to be the go-to brand for African entrepreneurs seeking success in today’s digital economy.

MTN’s commitment to supporting SMEs through MoMo APIs has garnered global recognition, winning prestigious awards such as the Global Telecom Award (Glotel) and the MEA Finance Banking Technology Award. These accolades underscore MTN’s leadership in fostering digital innovation and financial inclusion across Africa.

Nkululeko Nkosi, co-founder of Saturated, envisions a world where businesses seamlessly embrace innovation and transformation. Launched in January 2020, Saturated specialises in web and app development, software solutions and digital consultancy for cloud computing. The onset of COVID-19 highlighted the imperative for small businesses to pivot online, motivating Nkululeko to enter Saturated into

MTN’s Xlerator programme, a year-long initiative supporting business growth and development. Through Xlerator, Nkululeko developed a holistic approach to business enhancement and gained the resources needed to flourish. “The programme assisted us in improving the business elements that we were not aware and offered us insight into running a successful digital business. MTN provided resources to support us in every facet of our business, from legal, HR and accounting skills.”

With a commitment to achieve Net Zero GHG emissions within the value chain by 2040, and halve them by 2030, Ericsson is pioneering a sustainable future and leads the industry by example through its solutions. These targets are 1.5C aligned and validated by the Science-based Target initiative (SBTi). Signing the pledge supports MTN and Ericsson’s aims to achieve ambitious Net Zero goals and prioritises climate action for Africa’s socioeconomic future.

This collaboration can potentially address Scope 3 emissions, which are indirect emissions that occur in a company’s value chain outside their direct operations. Scope 3 emissions often comprise a substantial part of organisations’ footprints and are difficult to calculate and control as a result of limited operational influence and intricate supply chain involvement. Collaborations like Ericsson and MTN’s, where we potentially share upstream and downstream value chain suppliers, can improve opportunities to communicate with, engage and support supply chain partners, ultimately contributing to the goal of reducing emissions.

By leveraging Ericsson’s latest and most advanced sustainable technologies, MTN will be in a better position to realise its energy use and carbon management efforts in line with its commitment to reach Net Zero emissions by 2040. Implementing energy efficiency, network optimisation and sustainable practices throughout the value chain can help both companies contribute to a lower carbon footprint for the ICT sector.

Ericsson’s science-based approach to climate action will benefit the company, its stakeholders, and society. MTN is committed to protecting the planet and achieving Net Zero emissions by 2040. Our Net Zero goals are aligned, and together, we are working to contribute towards the sustainable development of society. To strengthen the collaboration, recently, Ericsson and MTN Group announced a Memorandum of Understanding (MoU) aimed at advancing sustainability across Africa. Under the MoU, the companies will explore, among others, opportunities to develop and promote innovative ICT solutions for the decarbonisation of their value chain ecosystem, enabling sustainable practices and contributing towards achieving their Net Zero commitments.

It doesn’t matter who you are, where you are, or what you do – the need to feed our human bodies is one of life’s great equalizers. Food is something that some of us take for granted, and that others have in such minimal amounts that they can barely stay alive. We have a food problem. According to an organization called Future Agenda, the world will need 60% more calories per day to feed 9 billion people by 2050. And yet the world wastes 2 billion tonnes of food every year. A large portion of that food is wasted at an agricultural level – before it even reaches a factory or your dinner table. If ever we needed a reason to use technology to solve a global problem, this is it.

The UN reports that almost half of the African population relies on agriculture to make a living. Imagine the potential to solve our food problem if we could enable half the African population, 530 million people, to farm more efficiently? It all starts with a connection. When farmers are connected, Internet of Things solutions become a reality.

MTN has over 1000 rural sites, taking us closer to a truly connected continent.

The Internet of Things has become a major contributor to a concept called precision agriculture. The objectives in combining technology with farming include higher yields, reduction of operating costs and an overall increase in efficiency. One example can be found in Kenya. A company called UjuziKilimo installs sensors in farm soil which send data to farmers’ mobile devices. This data includes weather updates which helps farmers decide when to plant seeds in our ever-changing climate, and even information about soil quality. Farmers only need to send a text message to UjuziKilimo for the team to come out and begin with a farm-analysis. And when farmers are connected, they are able to share the data they receive with their neighbours – spreading the knowledge, and amplifying the impact so that everyone is maximizing the potential of their own farms. In South Africa, farmers are also making use of mobile apps to send alerts about pest problems and receive weather updates and other farming related advice.

A sustainable farm is a successful one which makes a far-reaching impact. More people can be employed in the agriculture sector when farming is efficient, and more food is produced to feed our growing global population.

All of these solutions are only possible because of our natural eagerness to innovate, and the ability to do so with technology and connectivity as a solid foundation. Technology and people truly can be good together – and that’s food for thought!

References:

Global Farmer Network – Rwanda Leadership Honoured [Link removed]

Farmers Weekly – New Smartphone Apps to Help Farmers

Brookings – Foresight Africa 2016

Cause and effect. It is the backbone of science, and the reality of our daily lives. Sometimes, the effect is minimal and even unremarkable. Other times, the effect is big enough to change the trajectory of entire lives.

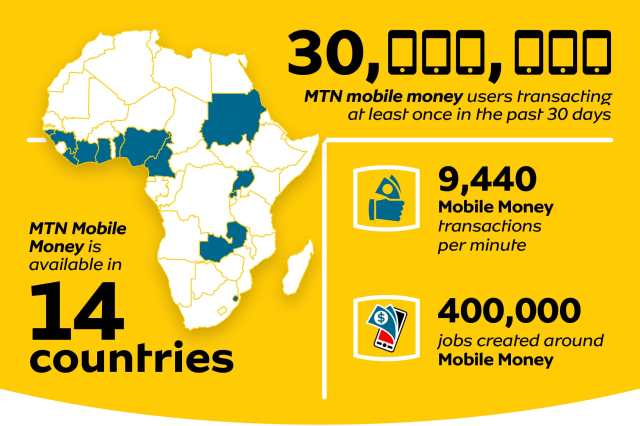

We see examples of cause and effect in technology all the time. A single tweet, a new invention, a simple app, can change the future. One example worth noting, is mobile money. Mobile money is changing the way millions of people manage their finances, and it has led to the creation of a new ecosystem. We estimate that the MTN mobile money ecosystem has contributed to the creation of 400 000 jobs across our footprint.

Consider how different your life would be if you didn’t have access to financial services. Is there a safe place for you to put your salary, in cash, every month? How would you purchase a home or pay school fees? Would you be able to stand in a queue every month to pay your bills in cash? Would you ever have a chance to get a loan? For the majority of people living in Africa, this is reality. The rise of mobile money is not just convenient, it is life changing. And it has created a ripple effect across an entire continent which goes much further than convenience.

The GSMA reports that more than a decade into the creation of mobile money, transactions to the value of $1.3 Billion per day were done in 2018.

A typical active mobile money user transacts to the value of $206 per month. This number is expected to grow as the adoption of mobile money is growing by 20% every year. MTN is proud to play a part in financial transformation on the continent, ensuring that our subscribers have access to a mobile way of managing money where traditional institutions are unable to assist.

Imagine yourself as a talented entrepreneur living in an African country, selling products to people in your community. A laptop and a mobile phone may enable you to build an online store and market your products to the world, but without a bank account, how would you make transactions beyond your physical reach? Mobile money is giving entrepreneurs a chance to start and grow their businesses. With more successful businesses, come more opportunities for employment.

Mobile Money provides two streams of financial empowerment. The first, is that with a small sum of cash and a mobile phone, the youth which make up the majority of Africa, can become Mobile Money agents. Today MTN Mobile Money is working with 400,000 agents . The second stream is for innovative entrepreneurs who leverage mobile money to collect payments. The ability to collect payments digitally is a step toward digitizing a business and being truly innovative. For example, prepaid solar power and water providers have been able to reach remote areas of the continent while insurance companies have been able to disrupt their commercial models by creating products for consumers that previously had no access to insurance services – all by leveraging the mobile money platform.

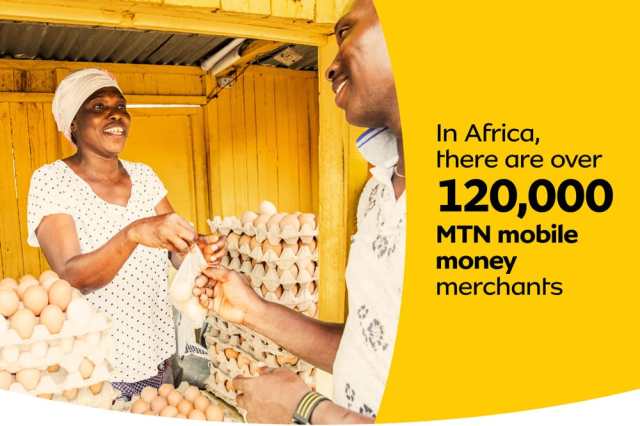

With the rise of mobile money, came the demand for merchants. There are 120 000 MTN mobile money merchants in Africa which implies 120 000 businesses have been able to increase their revenue. By accepting digital payments and bringing a digital element to traditionally brick-and-mortar businesses, Mobile Money can play a central role in empowering entrepreneurs. Becoming true drivers for economic and social growth, entrepreneurs can grow their businesses and employ people. This has a direct effect on the bottom line for people who have previously been ignored by traditional financial institutions.

A simple app, a few organisations working together, a continent full of talents and entrepreneurs and millions of people in need of financial services have contributed to the creation of 400 000 jobs. Could you think of a better example of technology making a meaningful impact?

Consider an ambitious woman who lives in a remote part of Zambia. She runs a small business, and starts using mobile money to accept payments from customers. With that same mobile money platform, she starts to send funds to family members in other parts of the country, paying for emergencies, health care and everything else her family may need. She may be hundreds of kilometres away, but her family still needs her, and she is able to meet their needs because of the technology in her pocket. Using mobile money to pay for her daughter’s school fees saves the woman from queuing to pay bills, buying her more time to increase her business revenue. When the sun sets, she uses mobile money to access solar power solutions so she can turn the lights on and keep going. And when she is ready to take her business to new heights, it is through mobile money that she can access a micro loan because mobile money has given her a financial history. This financial stability leads to stability in her business and in her home.

MTN now has 30 million active mobile money subscribers in 14 countries on the continent.

The range of solutions to close the financial services gap in the markets in which we operate requires partnerships with financial services providers, regulatory authorities, other mobile network operators, merchants, distributors, innovators and business associations. It is through working with our partners that MTN now has 30 million active mobile money subscribers in 14 countries on the continent – this has significantly improved the economic and social well-being of millions of Africans.

How Mobile Money Affects Social and Financial Inclusion

How Mobile Money Affects Social and Financial InclusionThe World Bank defines social inclusion as the process of improving the terms for individuals and groups to take part in society. Participation in society comes in three forms; markets, services and spaces. Markets, specifically, refer to labour, housing and credit. Mobile money is giving unbanked people in Africa the opportunity to participate in local and global markets. When wages are paid digitally to a mobile wallet, people with no traditional ‘paper trail’ suddenly have a digital trail and proof that they are able to earn and spend, and most importantly, save. Creating or growing a business becomes a reality, because money can safely be put aside for future investments. Eventually, that growing business requires staff to operate and continue growing. So jobs are created, and the community benefits.

This is not the story of one woman who wanted to grow a business. It is the story of millions of people in Africa on a journey to financial transformation. We estimate that MTN Mobile Money has contributed to the creation of 400 000 jobs across the company’s footprint. If you’d like to read about the ripple effect of this phenomenon, click here.

References:

OECD Library – Africa’s Development Dynamics 2018

The World Bank – Social Inclusion in Africa

There are children who seem to be born with an iPad in their hands, and there are those who will not have access to a computer until they reach a certain grade at school. Both groups will grow up in a digital world, and both groups have a great chance of thriving in the digital world if they are provided with the skills, tools and mentoring required to become great at anything.

By investing in the digital education of children in Africa and the Middle East, we are levelling the playing field and preparing our youth to become innovators in the digital world.

How is a student meant to excel in a digital world when they have limited or zero access to computers and connectivity?

This is why part of MTN’s CSI funds are used to equip educational institutions with the digital tools needed to advance the United Nations’ Sustainable Development Goal of advancing the quality of education (UN SDG 4).

In Benin, where access to textbooks is limited, the MTN Benin Foundation created 50 digital classes for 50 schools. Digital literacy training was provided to the facilitators managing the classes, along with a donation of 1000 laptops and the necessary connectivity. Now, more than 15 000 students and 100 teachers have access to the learning materials required for a good education.

E-libraries, online journals and other digital learning and research materials not only fill the gap where physical books are lacking, they also give learners the opportunity to make technology the foundation of their education. Other initiatives include the donation of a digital library to an orphanage in Afghanistan, where 200 children now have access to 3000 e-books. In Ghana, MTN donated an ICT centre for university students who required online research materials. The centre benefits 10 000 learners and the lecturers at the university. Over the years, we have established more than 925 computer labs and ICT facilities, because we believe that everyone deserves the benefits of a modern connected life.

MTN Ghana constructed a 24 unit classroom block which benefits 10 000 learners every year.

There is no point in introducing a school to computers when the school’s classrooms are dilapidated, so MTN first ensures that those without the basics get the help they need. Through a programme MTN established called Y’ello Schools, the MTN Cameroon Foundation has constructed 31 classrooms, and installed 16 potable water points, to improve the learning conditions of at least 16 400 students and 154 teachers. In Uganda, partnering with an initiative called Promoting Equality in African Schools, the Foundation has played a major role in constructing 10 schools.

By donating and installing smart boards in schools and computers in media centres, children in Africa get the chance to innovate just like those in developed countries. By working together, we are levelling the playing field, so that learners in Africa have the foundation required to innovate and bring real transformation to the continent.